On July 2020, I hit my first $1M NW. It took me 4 years to go from $50K to over $1M NW. I started with ~$50K USD savings in June 2016 when I moved to USA from Canada.

How did I achieve my first $1M?

Looking back past 4 years, the following 2 factors contributed to my $1M+:

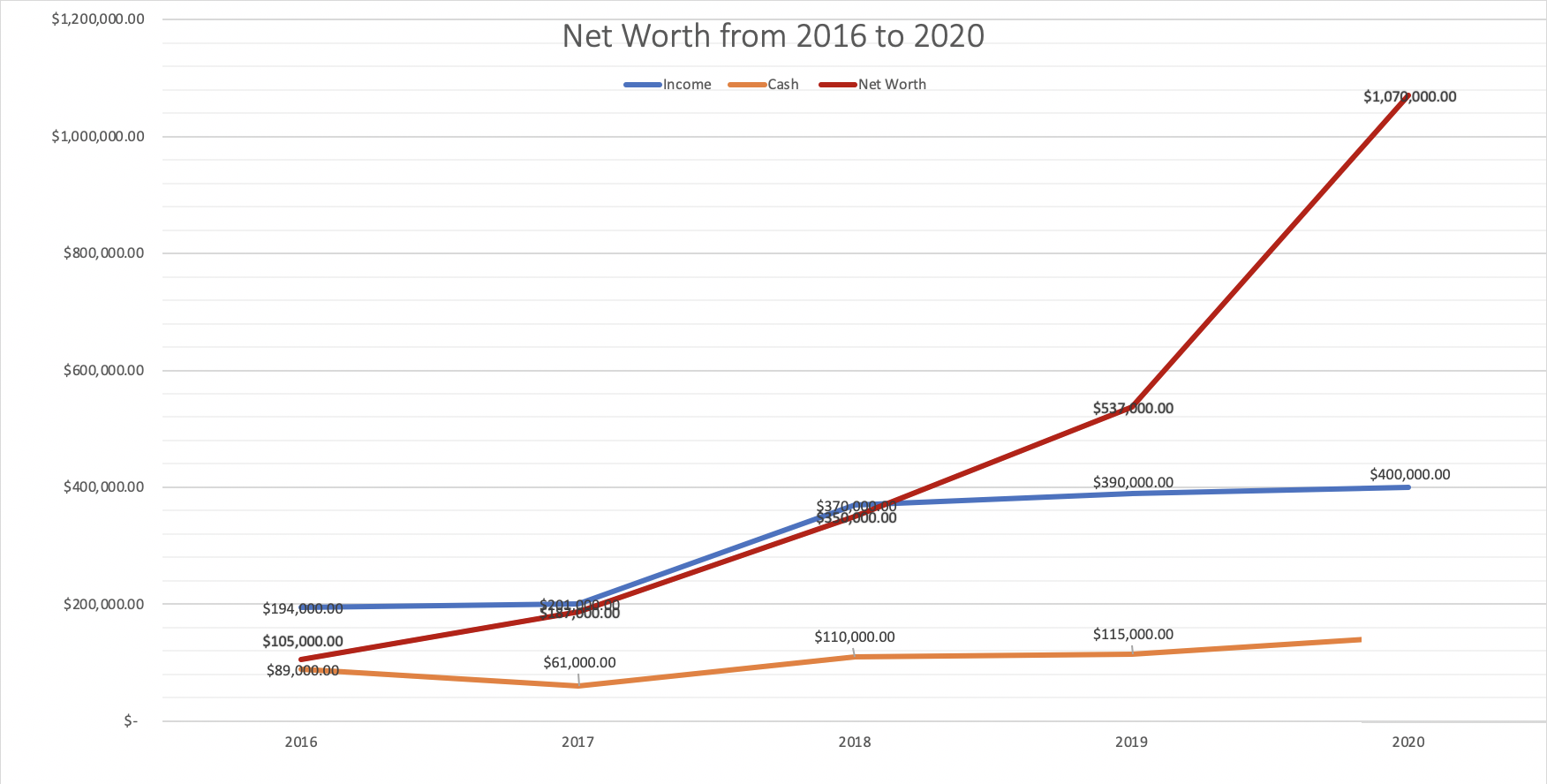

- High savings from my income – My income ranged from $200K to $400k. My income is from my salary, stock dividend and stock trading.

- I lived below my means keeping my expenses low. As my income increased from $200K to $400K, my expenses went down. My living expenses was ~$40K in 2016 and 2017. In 2018 and 2019, my expenses were $35K and $37K.

- In 2016 and 2017, I saved ~$80k/year. In 2018 and 2019, I saved $150k+ per year.

- Stock market – The insane stock growth from FAANG, MSFT, NVDA, BYND played a critical role in my building my NW.

- The stocks (MSFT, NFLX, TSLA, ARKK, SQ, NVDA, BYND) constitutes ~50% of NW. The pandemic accelerated my NW.

- Dividend stocks: I have also invested in blue chip dividend paying stocks generating me passive income.

- Trading Stocks: From 2019, I started trading stocks and have been consistently profitable.

- Crypto – a wash for me: I invested in crypto and made a nice return initially in early 2017 but I then invested during the peak of 2017 bubble and lost a good chunk of my profit.

Tracking my NW, income & cash savings over 4 years:

Learnings to apply for future

- Taking more risks in growth stocks – I looked out for companies that have projected 20% growth per year over next 5 years. I only put ~12% of portfolio in such stocks, which has now grown to become ~50% of my portfolio.

- Going forward: I need to take more risks and have such stocks ~20% of my portfolio.

- Avoid value traps in stocks – I have been buying AT&T, Coca cola, 3M etc. stocks which dividend aristocrats but a closer look shows in past 5 years they have only been increasing their dividend by 2-3% per year. On the contrary, SBUX, PEP have been increasing dividend by 5-12% per year past 5 years.

- Going forward: Look at their dividend growth past 5 years within dividend aristocrats.

- Reduce Tax bills – I need to keep more of my money. I have been consistently profitable past 18 out of 19 months trading stocks but I have been trading on my personal name which has limited my ability to do write offs such as rent, phone bills.

- Going forward: From 2021, I will trade under an LLC and have a holding company to have more write offs and reduce my trading profits tax rate from 35%+ to ~21% allowing me to keep more of my money.