2022 was one of the most important year for me.

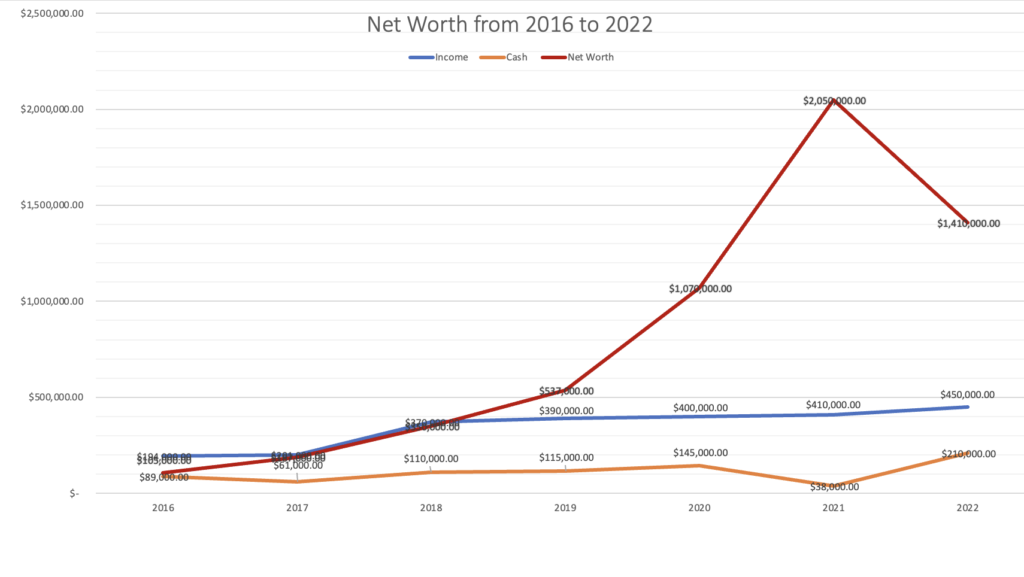

In early/Q1 2022, I hit $2M+ Net Worth in liquid (stocks and crypto) but by the end of 2022, I am now down to ~$1.4M (due to the crash in $TSLA, $BTC/crypto). At the start of 2022, due to massive gains from 2021, I decided to take stupid risks, which in hindsight makes no sense. I bought bunch of calls/puts of various speculative stocks to get rich quick and most of them went to zero.

The Key learnings for me :

-

- Be Diversified: It’s crucial to be diversified. My hyper growth stocks got crushed and down over 60% from its peak, but my value stocks portfolio retained its value (-10% from peak).

- There’s no get rich quick scheme: Due to lots of stupid risks I had a realized loss of ~$120k in 2022. My unrealized loss is another ~$250k. The IRS only allows $3k max loss per year, so I will need to carry my losses forward and offset with future gains.

- In contrast, I had ~$200k+ realized gains in 2021, with substantial unrealized gains. I used my gains to buy my recent/current multifamily property + renovate and the small vending business in 2022.

Here’s a chart of my NW from 2016 to 2022:

My income increased from just over $400k to inching close to $450k now. I make close to $30k in dividends, which is pretty neat. I will continue to invest to increase dividend income over the coming years.

I bought a small business in 2022:

- In Q3 – I bought a vending machine business from a retirees couple. I am getting ~25% ROI on the business if I was to manage it.I have hired an employee as contractor which has caused by ROI to drop to below 15% and I am happy with it.

Looking forward in 2023:

- No more stupid unmanaged risks: Prior to 2022, I had always kept my speculative risks to under 10% of my portfolio, but last year, I got carried away and YOLOed 20% to leaps (calls/puts) and lost most of it. I need to be better disciplined and keep my speculative in 5%.

- Increase online presence: I seriously need to start a YouTube channel and increase social media presence. I have been thinking about it and will share more in the coming days.

- Having bought a physical small business (vending machine business), I find it too little ROI for the risks involved. A small business is good if self managed or one needs to go big, otherwise the ROI just isnt worth it.

- Travel more: I spent 2 months in 2022 traveling in Amsterdam, London, Germany and Turkey and it was awesome. I intend to travel in 2023 for 3 months across Europe again.

- Dividend investment: I shall continue to increase dividend portfolio. The recent downtown has proven to me that blue-chip diversified portfolio across sectors is very hard to beat. For example in my dividend portfolio $QQQ is down a lot, but $ABBVIE, $XLE is substantially up.

- I am sitting on a good chunk of cash: I am sitting on $210k cash (my highest ever in past 5 years). I am not exactly sure what I would do, but I feel in 2023, having cash would enable me to buy a Real Estate or maybe another small business or buy equities at deeper discount. RE may not be a good choice given current mortgage rate is over 6%.

Thats it for now! Happy New Year 2022!